Introduction

In recent years, the Indian government has taken several measures to streamline and simplify administrative processes. “PAN Aadhaar Link Compulsory” One such initiative is the linking of the Permanent Account Number (PAN) with Aadhaar, the unique identification number issued to Indian residents. The PAN Aadhaar link is essential for individuals as it helps to establish their identity and facilitates seamless financial transactions. In this comprehensive step-by-step guide, we will walk you through the process of linking your PAN with Aadhaar. Continue Grow Your Knowledge with knowledegroww.om.

How to PAN Aadhaar Link Step-by-Step Guide

Why is the PAN Aadhaar link important?

The PAN Aadhaar link holds significant importance as it serves as a means to authenticate an individual’s identity and prevent fraudulent activities. The government aims to eliminate duplicate PAN cards and ensure a transparent taxation system. Additionally, linking PAN with Aadhaar simplifies the income tax filing process, making it more efficient for taxpayers.

Prerequisites for linking PAN with Aadhaar

Before you proceed with the PAN Aadhaar linking process, ensure that you have the following prerequisites:

- Valid PAN card details

- Valid Aadhaar card details

- Active mobile number linked to the Aadhaar card

- Active internet connection or access to a PAN service center

Online Method: Linking PAN with Aadhaar

Follow these steps to link your PAN with Aadhaar online:

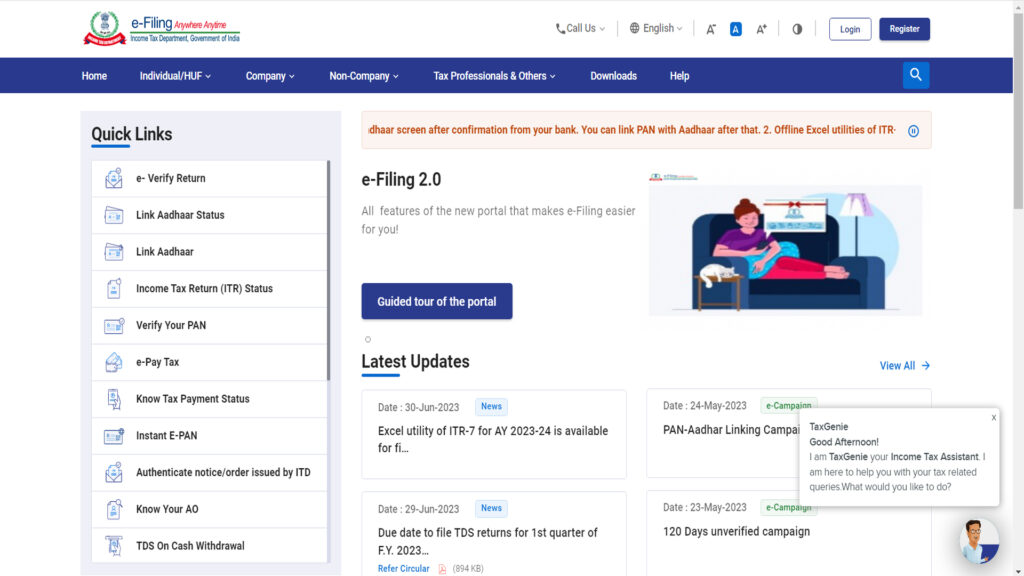

Step 1: Visit the official e-filing website

Open your preferred web browser and visit the official e-filing website of the Income Tax Department. https://eportal.incometax.gov.in/

Step 2: Click on the “Link Aadhaar” option

On the homepage of the e-filing website, locate the “Link Aadhaar” option. Click on it to proceed. https://eportal.incometax.gov.in/iec/foservices/#/pre-login/bl-link-aadhaar

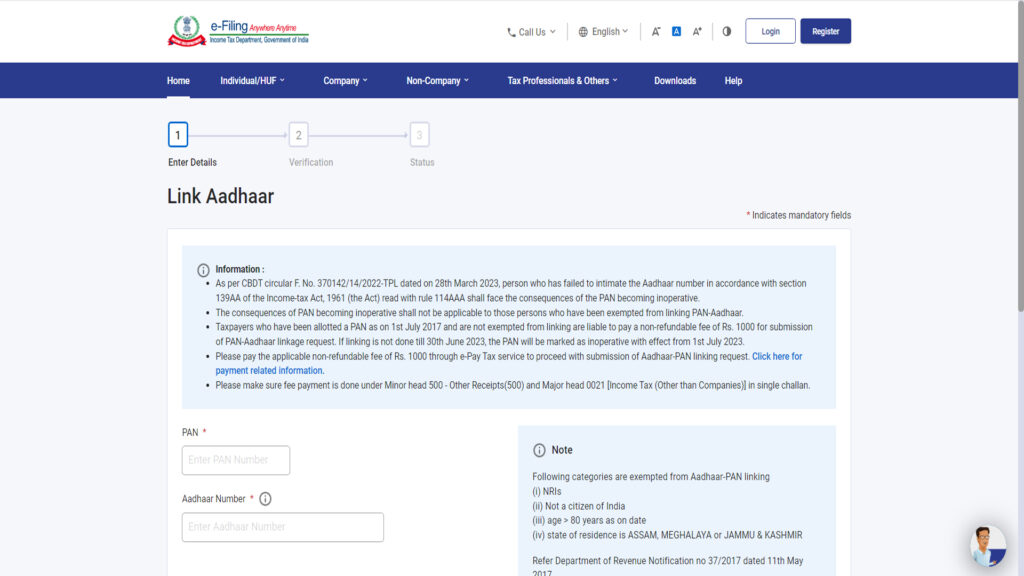

Step 3: Fill in the required details

Provide your PAN and Aadhaar card details in the respective fields. Cross-check the information to ensure accuracy.

Step 4: Verify your Aadhaar details

The system will automatically verify the details provided by you with the UIDAI (Unique Identification Authority of India) database. Ensure that the verification is successful.

Step 5: Enter the Aadhaar OTP

You will receive an OTP (One-Time Password) on your registered mobile number. Enter the OTP in the designated field to authenticate the linking process.

Step 6: Successful linking of PAN with Aadhaar

After successful OTP verification, a confirmation message will be displayed on the screen. This indicates that your PAN has been successfully linked with Aadhaar.

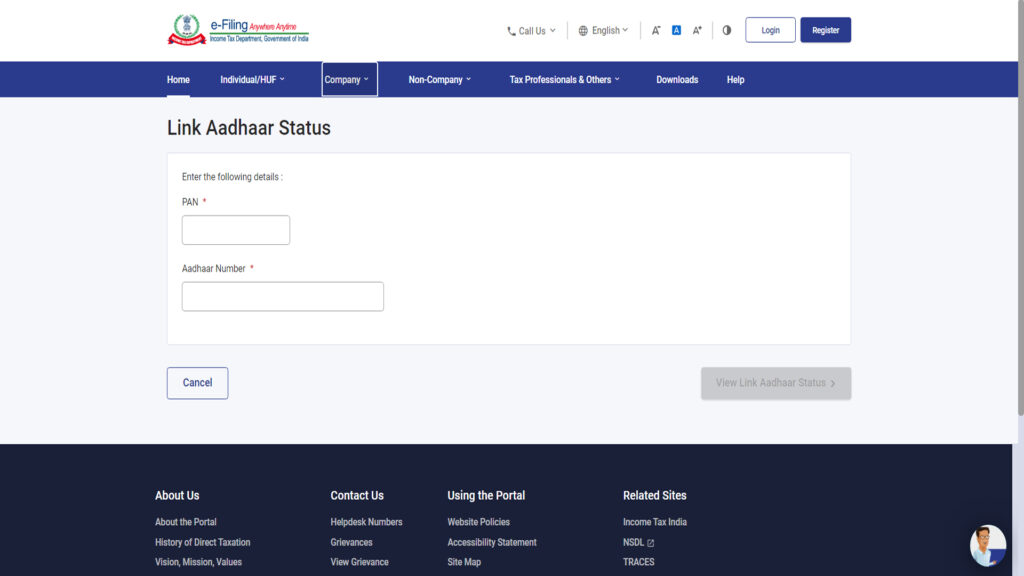

Pan Aadhar Link Status Link : https://eportal.incometax.gov.in/iec/foservices/#/pre-login/link-aadhaar-status

Offline Method: Linking PAN with Aadhaar

In case you prefer an offline approach, follow these steps to link your PAN with Aadhaar:

Step 1: Visit the nearest PAN service center

Locate the nearest PAN service center in your area. You can find this information on the official website of the Income Tax Department.

Step 2: Fill out the PAN Aadhaar linking form

Collect the PAN Aadhaar linking form available at the service center. Fill in the required details accurately.

Step 3: Submit the form along with supporting documents

Attach a self-attested copy of your PAN card and Aadhaar card along with the filled-out form. Submit these documents to the designated authority.

Step 4: Acknowledgment receipt

Upon successful submission, the authority will provide you with an acknowledgment receipt. Keep this receipt safe for future reference.

Step 5: PAN Aadhaar link completed

The PAN Aadhaar link process will be completed by the concerned authority based on the information provided by you. You will receive a notification once the linking is done.

FEE : Payment Related Information

The fee payment for PAN-Aadhaar Linkage need to be made through e-Pay Tax functionality available on e-filing Portal.

Steps for payment through e-Pay Tax:

- Provide your PAN, Confirm PAN and Mobile number to receive OTP Or navigate to post login e-File > e-Pay Tax> Select New Payment

- Post OTP verification, you will be redirected to a page showing different payment tiles

- Click Proceed on the Income Tax tile

- Select AY as 2024-25 and Type of Payment – as other Receipts (500) and Continue

- Preview the amount as Rs. 1000 under ‘Others’ field in tax break-up and proceed with further steps

Payment Verification Method:

- Taxpayer will receive challan receipt on successful payment. User can also check bank account statement to ensure if amount was deducted or not.

- Taxpayer can view and download the challan by navigating to e-File > e-Pay Tax> Payment History or check the challan status through “Know Payment Status” under Quick Links on e-Filing Home page.

Common Issues and Troubleshooting

While linking PAN with Aadhaar, you may encounter some common issues. Here are a few solutions:

Issue 1: Name mismatch between PAN and Aadhaar

If you notice a name mismatch between your PAN and Aadhaar, update the details with the relevant authority. This can be done online or by visiting a PAN service center.

Issue 2: Invalid or deactivated Aadhaar

Ensure that your Aadhaar card is valid and active. If it is deactivated or deemed invalid, you must contact the UIDAI for resolution.

Issue 3: Technical glitches on the e-filing website

In case you face technical glitches or errors on the e-filing website, try accessing the website during non-peak hours or clear your browser cache and cookies.

Issue 4: Inaccessible PAN service center

If the nearest PAN service center is inaccessible, you can contact the helpline number provided by the Income Tax Department for guidance on alternative options.

Benefits of Linking PAN with Aadhaar

The PAN Aadhaar link offers several benefits to individuals. Some of them include:

1. Simplified income tax filing

Linking PAN with Aadhaar simplifies the income tax filing process as it automatically fetches the individual’s relevant information, reducing manual effort and ensuring accuracy.

2. Enhanced transparency and accountability

The PAN Aadhaar link enhances transparency and accountability in financial transactions. It helps the government track taxable transactions and identify tax evaders.

3. Reduction in duplicate PAN cards

By linking PAN with Aadhaar, the government aims to eliminate duplicate PAN cards, which can be misused for illegal activities or tax evasion.

4. Prevention of tax evasion

The PAN Aadhaar link acts as a deterrent against tax evasion. It ensures that individuals’ financial transactions are recorded and reported accurately, minimizing the chances of tax evasion.

Conclusion

Linking your PAN with Aadhaar is a crucial step towards establishing your identity and complying with the Indian taxation system. It simplifies the income tax filing process and promotes transparency in financial transactions. Whether you choose the online or offline method, make sure to follow the step-by-step process to successfully link your PAN with Aadhaar.

FAQs (Frequently Asked Questions)

- How long does it take to link PAN with Aadhaar?

- The linking process is usually completed instantly or within a few days, depending on the method chosen.

- Is it mandatory to link PAN with Aadhaar?

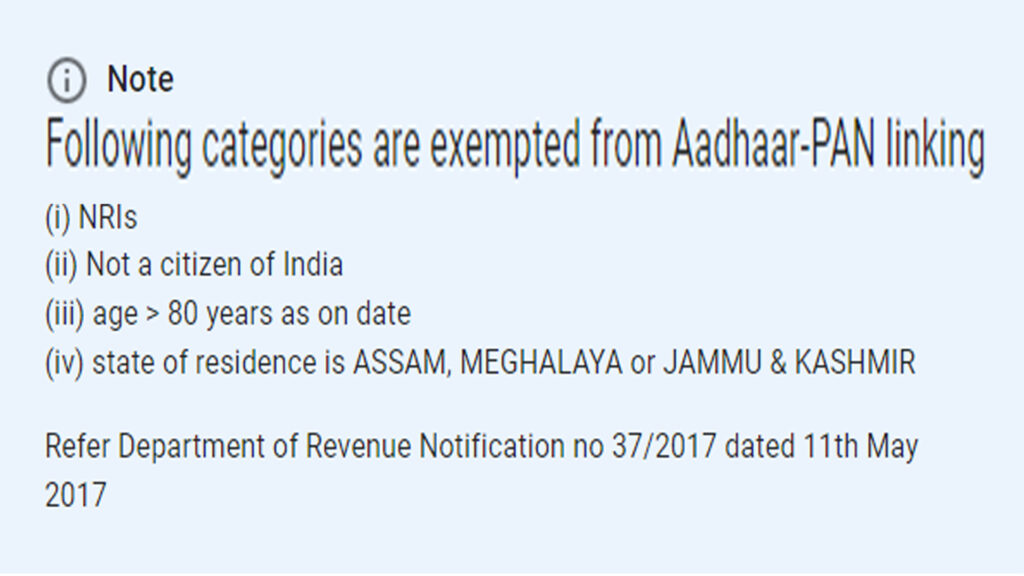

- Yes, as per the Income Tax Department’s notification, linking PAN with Aadhaar is mandatory for all individuals.

- Can I link multiple PAN cards with the same Aadhaar?

- No, Aadhaar can be linked with only one PAN card. It is illegal to possess multiple PAN cards.

- What happens if I fail to link PAN with Aadhaar?

- Failure to link PAN with Aadhaar may result in the invalidation of your PAN card and may lead to difficulties in financial transactions and income tax filings.

- Can I link my Aadhaar with someone else’s PAN?

- No, Aadhaar can only be linked with your own PAN card. It is not permissible to link someone else’s PAN with your Aadhaar.